Quarterly Report

Q4 2025

“The Alturas Real Estate Fund remains a top performer with margin to spare. As the market continues to recover, we are well positioned for continued success.”

As we reflect on 2025, in many ways, it was one of the most difficult years of the Fund’s history. That said, difficulties create opportunities to set ourselves apart and show what we are made of. As we look back on the year and look out across the broader real estate market, the Alturas Real Estate Fund remains a top performer with margin to spare. As the market continues to recover, we are well positioned for continued success. What has set us apart over the first decade of the Fund is an emphasis on long-term results that are built through people, partnerships, and execution rather than a transactional approach to investing – this approach remains our core focus.

For the quarter, realized returns were 16.50%, and total returns were 15.89%. For the full year, realized returns were 12.43% and total returns were 13.60%. In an environment where many real estate investments are struggling to generate attractive returns, this is an exceptional outcome and one that clearly stands out relative to peer performance.

We are proud of what the team accomplished this year. From acquiring several new assets, to successfully exiting others, and making progress in our leasing and development initiatives across the portfolio. These results highlight the resilience of the portfolio, strength of our partnerships, and our team that gets things done. We are hitting the ground running in 2026! This year will likely present similar opportunities and challenges, among many unknown changes. While we don’t know what tomorrow may bring, one thing is certain, we will find ways to create and realize value and in doing so generate returns for our partners.

Sourcing attractive returns in today’s environment is challenging. Asset pricing is elevated, and competition for properties is intense. As a result, compelling opportunities are increasingly found through creativity, patience, and a willingness to engage in more complex situations rather than settle for market rate transactions. Our focus continues to be on creating opportunities through our tenant relationships, broker network, development capabilities, and partnerships that allow us to win in the current environment with upside for the future.

The sale of Decker Lake is a clear example of this approach. Years of leasing and asset management work ultimately translated into a successful sale of the asset, highlighting the value embedded across the portfolio. Similarly, the Ogden development project reflects our ability to access opportunities through trusted relationships and create value through our hands-on approach and alignment with the right partners who can execute.

The open-ended structure of the Fund continues to be a significant advantage in this environment. It allows us to be selective about when and where capital is deployed, whether through new acquisitions, incremental investment to support leasing and operations across the portfolio, while also enabling us to sell assets when we believe value has been maximized and redeploy capital without artificial timing pressure. This flexibility supports disciplined decision-making as market conditions continue to evolve.

As we move into 2026, we are seeing a growing pipeline of opportunities that will likely allow us to accept new investments (see Acquisition Pipeline below). For partners considering an additional investment or those interested in participating in upcoming capital raises, we encourage you to reach out to our investor relations team to discuss the current and near-term opportunities.

Looking ahead, we remain focused on the underlying performance of the portfolio and the continued execution of leasing and development initiatives already underway, including our spec suite and build-to-suit programs, as well as completing development projects within the portfolio. This past year demonstrated our ability to execute despite the current market backdrop, and while challenges may persist, we are confident that the strength of our team and our partnership with you will allow us to continue to win.

Travis Barney, Chief Executive Officer

Alturas Capital Partners, LLC

Devin Morris, Chief Operating Officer

Alturas Capital Partners, LLC

Blake Hansen, Chief Investment Officer

Alturas Capital Partners, LLC

As we reflect on 2025, in many ways, it was one of the most difficult years of the Fund’s history. That said, difficulties create opportunities to set ourselves apart and show what we are made of. As we look back on the year and look out across the broader real estate market, the Alturas Real Estate Fund remains a top performer with margin to spare. As the market continues to recover, we are well positioned for continued success. What has set us apart over the first decade of the Fund is an emphasis on long-term results that are built through people, partnerships, and execution rather than a transactional approach to investing – this approach remains our core focus.

For the quarter, realized returns were 16.50%, and total returns were 15.89%. For the full year, realized returns were 12.43% and total returns were 13.60%. In an environment where many real estate investments are struggling to generate attractive returns, this is an exceptional outcome and one that clearly stands out relative to peer performance.

We are proud of what the team accomplished this year. From acquiring several new assets, to successfully exiting others, and making progress in our leasing and development initiatives across the portfolio. These results highlight the resilience of the portfolio, strength of our partnerships, and our team that gets things done. We are hitting the ground running in 2026! This year will likely present similar opportunities and challenges, among many unknown changes. While we don’t know what tomorrow may bring, one thing is certain, we will find ways to create and realize value and in doing so generate returns for our partners.

Sourcing attractive returns in today’s environment is challenging. Asset pricing is elevated, and competition for properties is intense. As a result, compelling opportunities are increasingly found through creativity, patience, and a willingness to engage in more complex situations rather than settle for market rate transactions. Our focus continues to be on creating opportunities through our tenant relationships, broker network, development capabilities, and partnerships that allow us to win in the current environment with upside for the future.

The sale of Decker Lake is a clear example of this approach. Years of leasing and asset management work ultimately translated into a successful sale of the asset, highlighting the value embedded across the portfolio. Similarly, the Ogden development project reflects our ability to access opportunities through trusted relationships and create value through our hands-on approach and alignment with the right partners who can execute.

The open-ended structure of the Fund continues to be a significant advantage in this environment. It allows us to be selective about when and where capital is deployed, whether through new acquisitions, incremental investment to support leasing and operations across the portfolio, while also enabling us to sell assets when we believe value has been maximized and redeploy capital without artificial timing pressure. This flexibility supports disciplined decision-making as market conditions continue to evolve.

As we move into 2026, we are seeing a growing pipeline of opportunities that will likely allow us to accept new investments (see Acquisition Pipeline below). For partners considering an additional investment or those interested in participating in upcoming capital raises, we encourage you to reach out to our investor relations team to discuss the current and near-term opportunities.

Looking ahead, we remain focused on the underlying performance of the portfolio and the continued execution of leasing and development initiatives already underway, including our spec suite and build-to-suit programs, as well as completing development projects within the portfolio. This past year demonstrated our ability to execute despite the current market backdrop, and while challenges may persist, we are confident that the strength of our team and our partnership with you will allow us to continue to win.

Travis Barney, Chief Executive Officer

Alturas Capital Partners, LLC

Devin Morris, Chief Operating Officer

Alturas Capital Partners, LLC

Blake Hansen, Chief Investment Officer

Alturas Capital Partners, LLC

As we reflect on 2025, in many ways, it was one of the most difficult years of the Fund’s history. That said, difficulties create opportunities to set ourselves apart and show what we are made of. As we look back on the year and look out across the broader real estate market, the Alturas Real Estate Fund remains a top performer with margin to spare. As the market continues to recover, we are well positioned for continued success. What has set us apart over the first decade of the Fund is an emphasis on long-term results that are built through people, partnerships, and execution rather than a transactional approach to investing – this approach remains our core focus.

For the quarter, realized returns were 16.50%, and total returns were 15.89%. For the full year, realized returns were 12.43% and total returns were 13.60%. In an environment where many real estate investments are struggling to generate attractive returns, this is an exceptional outcome and one that clearly stands out relative to peer performance.

We are proud of what the team accomplished this year. From acquiring several new assets, to successfully exiting others, and making progress in our leasing and development initiatives across the portfolio. These results highlight the resilience of the portfolio, strength of our partnerships, and our team that gets things done. We are hitting the ground running in 2026! This year will likely present similar opportunities and challenges, among many unknown changes. While we don’t know what tomorrow may bring, one thing is certain, we will find ways to create and realize value and in doing so generate returns for our partners.

Sourcing attractive returns in today’s environment is challenging. Asset pricing is elevated, and competition for properties is intense. As a result, compelling opportunities are increasingly found through creativity, patience, and a willingness to engage in more complex situations rather than settle for market rate transactions. Our focus continues to be on creating opportunities through our tenant relationships, broker network, development capabilities, and partnerships that allow us to win in the current environment with upside for the future.

The sale of Decker Lake is a clear example of this approach. Years of leasing and asset management work ultimately translated into a successful sale of the asset, highlighting the value embedded across the portfolio. Similarly, the Ogden development project reflects our ability to access opportunities through trusted relationships and create value through our hands-on approach and alignment with the right partners who can execute.

The open-ended structure of the Fund continues to be a significant advantage in this environment. It allows us to be selective about when and where capital is deployed, whether through new acquisitions, incremental investment to support leasing and operations across the portfolio, while also enabling us to sell assets when we believe value has been maximized and redeploy capital without artificial timing pressure. This flexibility supports disciplined decision-making as market conditions continue to evolve.

As we move into 2026, we are seeing a growing pipeline of opportunities that will likely allow us to accept new investments (see Acquisition Pipeline below). For partners considering an additional investment or those interested in participating in upcoming capital raises, we encourage you to reach out to our investor relations team to discuss the current and near-term opportunities.

Looking ahead, we remain focused on the underlying performance of the portfolio and the continued execution of leasing and development initiatives already underway, including our spec suite and build-to-suit programs, as well as completing development projects within the portfolio. This past year demonstrated our ability to execute despite the current market backdrop, and while challenges may persist, we are confident that the strength of our team and our partnership with you will allow us to continue to win.

Travis Barney, Chief Executive Officer

Alturas Capital Partners, LLC

Devin Morris, Chief Operating Officer

Alturas Capital Partners, LLC

Blake Hansen, Chief Investment Officer

Alturas Capital Partners, LLC

Photo: Sawtooth Mountains, ID

Q4 Key Numbers

Photo: Sawtooth Mountains, ID

Q4 Key Numbers

16.50%

Average Realized Return

16.50%

Average Realized Return

16.50%

Average Realized Return

15.89%

Average Total Return

15.89%

Average Total Return

15.89%

Average Total Return

$11.00M

Realized Net Income

$11.00M

Realized Net Income

$11.00M

Realized Net Income

$1,681.76

Unit Price

$1,681.76

Unit Price

$1,681.76

Unit Price

$713.15M

Assets Under Management

$713.15M

Assets Under Management

$713.15M

Assets Under Management

*Stated returns are average annualized investor returns. Individual investor returns may vary based on the unit pricing at the time of investment. Realized net income includes realized gains and losses and excludes unrealized gains and losses recorded during the period. Financial information herein related to the quarters ended in 2025 are unaudited as of the date of this report.

Photo: Arches National Park, UT

Q4 Acquisitions

Photo: Arches National Park, UT

Q4 Acquisitions

Photo: Arches National Park, UT

Q4 Acquisitions

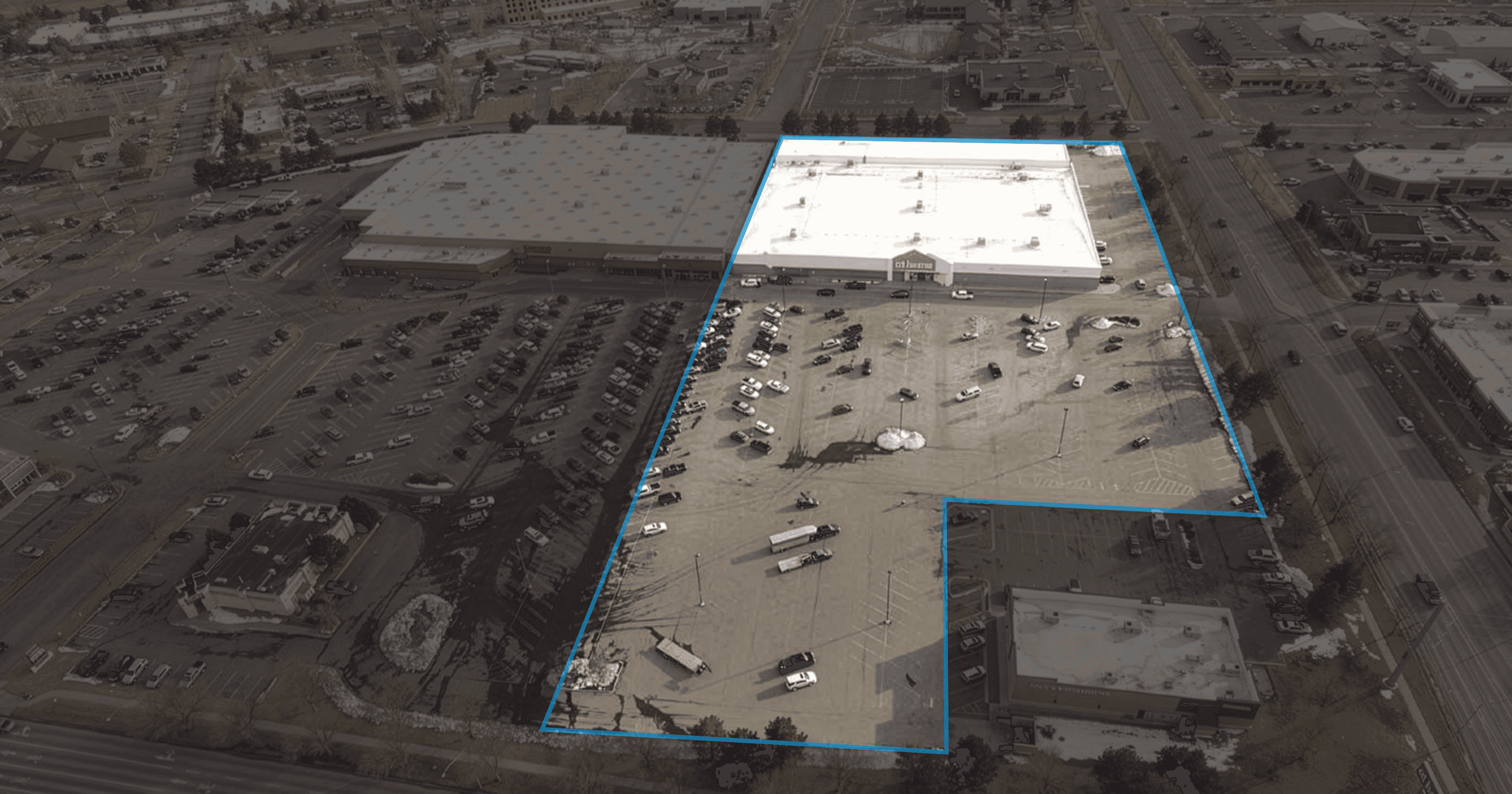

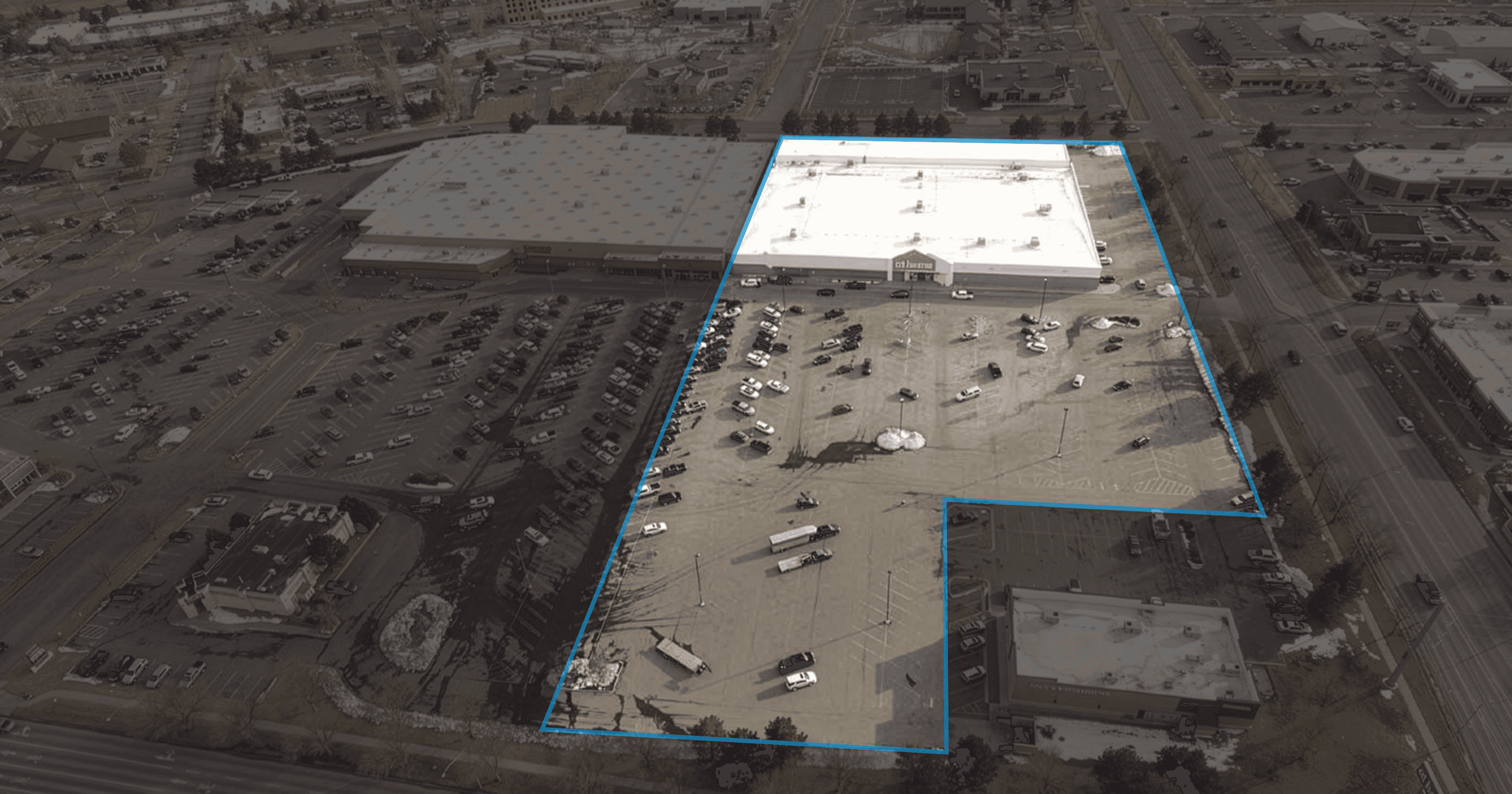

Odgen Development

Odgen, UT

Retail

14.36 Acres

The Ogden development project is a former Fred Meyer site that was awarded to a regional hospital system following litigation but ultimately remained undeveloped. Our broker partners identified this development opportunity and invited us to participate alongside them to help bring the project to completion. We acquired the property at approximately 1/3 of its appraised value, creating a compelling value-add opportunity. Our development plan includes retail shop space, single tenant assets, mid-box retail, and potential pad sales. We already have significant tenant interest; our low basis and local partnerships will create significant value add opportunities.

Odgen Development

Odgen, UT

Retail

14.36 Acres

The Ogden development project is a former Fred Meyer site that was awarded to a regional hospital system following litigation but ultimately remained undeveloped. Our broker partners identified this development opportunity and invited us to participate alongside them to help bring the project to completion. We acquired the property at approximately 1/3 of its appraised value, creating a compelling value-add opportunity. Our development plan includes retail shop space, single tenant assets, mid-box retail, and potential pad sales. We already have significant tenant interest; our low basis and local partnerships will create significant value add opportunities.

Odgen Development

Odgen, UT

Retail

14.36 Acres

The Ogden development project is a former Fred Meyer site that was awarded to a regional hospital system following litigation but ultimately remained undeveloped. Our broker partners identified this development opportunity and invited us to participate alongside them to help bring the project to completion. We acquired the property at approximately 1/3 of its appraised value, creating a compelling value-add opportunity. Our development plan includes retail shop space, single tenant assets, mid-box retail, and potential pad sales. We already have significant tenant interest; our low basis and local partnerships will create significant value add opportunities.

Take 5

Twin Falls, ID

Retail

1,400 SF

The most recent Take 5 acquisition marks the Fund’s seventh Take 5 development in Idaho. It is currently under construction and completed in collaboration with our franchisee partner. Similar to other locations developed alongside Lowe’s, this site reflects a strategic partnership between the two businesses aimed at serving complimentary clientele.

Take 5

Twin Falls, ID

Retail

1,400 SF

The most recent Take 5 acquisition marks the Fund’s sixth Take 5 development in Idaho. It is currently under construction and being completed in collaboration with our franchisee partner. Similar to other locations developed alongside Lowe’s, this site reflects a strategic partnership between the two businesses aimed at serving complimentary clientele.

Take 5

Twin Falls, ID

Retail

1,400 SF

The most recent Take 5 acquisition marks the Fund’s seventh Take 5 development in Idaho. It is currently under construction and completed in collaboration with our franchisee partner. Similar to other locations developed alongside Lowe’s, this site reflects a strategic partnership between the two businesses aimed at serving complimentary clientele.

Take 5

Twin Falls, ID

Retail

1,400 SF

The most recent Take 5 acquisition marks the Fund’s sixth Take 5 development in Idaho. It is currently under construction and being completed in collaboration with our franchisee partner. Similar to other locations developed alongside Lowe’s, this site reflects a strategic partnership between the two businesses aimed at serving complimentary clientele.

Photo: Monument Valley Navajo Tribal Park, UT

Q4 Dispositions

Photo: Monument Valley Navajo Tribal Park, UT

Q4 Dispositions

Shops at Decker Lake

Salt Lake City, UT

Retail

52,387 SF

We completed the sale of The Shops at Decker Lake, a retail center located in Salt Lake City, Utah. The property was acquired in March 2019 at approximately 68% occupancy, with a tenant mix that included several lower-credit tenants and near-term rollover, including the eventual vacancy of the center’s largest tenant. During our ownership, we were successful in improving the tenant mix and completed improvements to the façade, enhancing the overall quality of the center. These efforts ultimately resulted in the property being 100% leased prior to sale. Although we did not intend to sell the center, we received an unsolicited offer that exceeded what we believed was the long-term intrinsic value of the property. As a result, we elected to realize the value created over the last several years, generating a substantial gain for the Fund and our partners.

Shops at Decker Lake

Salt Lake City, UT

Retail

52,387 SF

We completed the sale of The Shops at Decker Lake, a retail center located in Salt Lake City, Utah. The property was acquired in March 2019 at approximately 68% occupancy, with a tenant mix that included several lower-credit tenants and near-term rollover, including the eventual vacancy of the center’s largest tenant. During our ownership, we were successful in improving the tenant mix and completed improvements to the façade, enhancing the overall quality of the center. These efforts ultimately resulted in the property being 100% leased prior to sale. Although we did not intend to sell the center, we received an unsolicited offer that exceeded what we believed was the long-term intrinsic value of the property. As a result, we elected to realize the value created over the last several years, generating a substantial gain for the Fund and our partners.

Shops at Decker Lake

Salt Lake City, UT

Retail

52,387 SF

We completed the sale of The Shops at Decker Lake, a retail center located in Salt Lake City, Utah. The property was acquired in March 2019 at approximately 68% occupancy, with a tenant mix that included several lower-credit tenants and near-term rollover, including the eventual vacancy of the center’s largest tenant. During our ownership, we were successful in improving the tenant mix and completed improvements to the façade, enhancing the overall quality of the center. These efforts ultimately resulted in the property being 100% leased prior to sale. Although we did not intend to sell the center, we received an unsolicited offer that exceeded what we believed was the long-term intrinsic value of the property. As a result, we elected to realize the value created over the last several years, generating a substantial gain for the Fund and our partners.

Take 5 Eagle Road

Boise, ID

Retail

1,438 SF

We completed the sale of 2656 Eagle Road, a Take 5 Oil Change development located along one of Idaho’s busiest retail corridors. The land was originally acquired for two build-to-suit developments, with the second pad leased to Livewell Animal Hospital, a national veterinary brand, which is scheduled for completion this Spring. The property traded at a low cap rate, resulting in a 75.10% IRR. This outcome reflects the strength of the Fund’s development model, which is underwritten with a margin of safety on return on cost and downside protection. Because of this, the Fund can repeatedly develop and dispose of single tenant NNN assets to buyers willing to pay a premium and recycle capital efficiently.

Take 5 Eagle Road

Boise, ID

Retail

1,438 SF

We completed the sale of 2656 Eagle Road, a Take 5 Oil Change development located along one of Idaho’s busiest retail corridors. The land was originally acquired for two build-to-suit developments, with the second pad leased to Livewell Animal Hospital, a national veterinary brand, which is scheduled for completion this Spring. The property traded at a low cap rate, resulting in a 75.10% IRR. This outcome reflects the strength of the Fund’s development model, which is underwritten with a margin of safety on return on cost and downside protection. Because of this, the Fund can repeatedly develop and dispose of single tenant NNN assets to buyers willing to pay a premium and recycle capital efficiently.

Take 5 Eagle Road

Boise, ID

Retail

1,438 SF

We completed the sale of 2656 Eagle Road, a Take 5 Oil Change development located along one of Idaho’s busiest retail corridors. The land was originally acquired for two build-to-suit developments, with the second pad leased to Livewell Animal Hospital, a national veterinary brand, which is scheduled for completion this Spring. The property traded at a low cap rate, resulting in a 75.10% IRR. This outcome reflects the strength of the Fund’s development model, which is underwritten with a margin of safety on return on cost and downside protection. Because of this, the Fund can repeatedly develop and dispose of single tenant NNN assets to buyers willing to pay a premium and recycle capital efficiently.

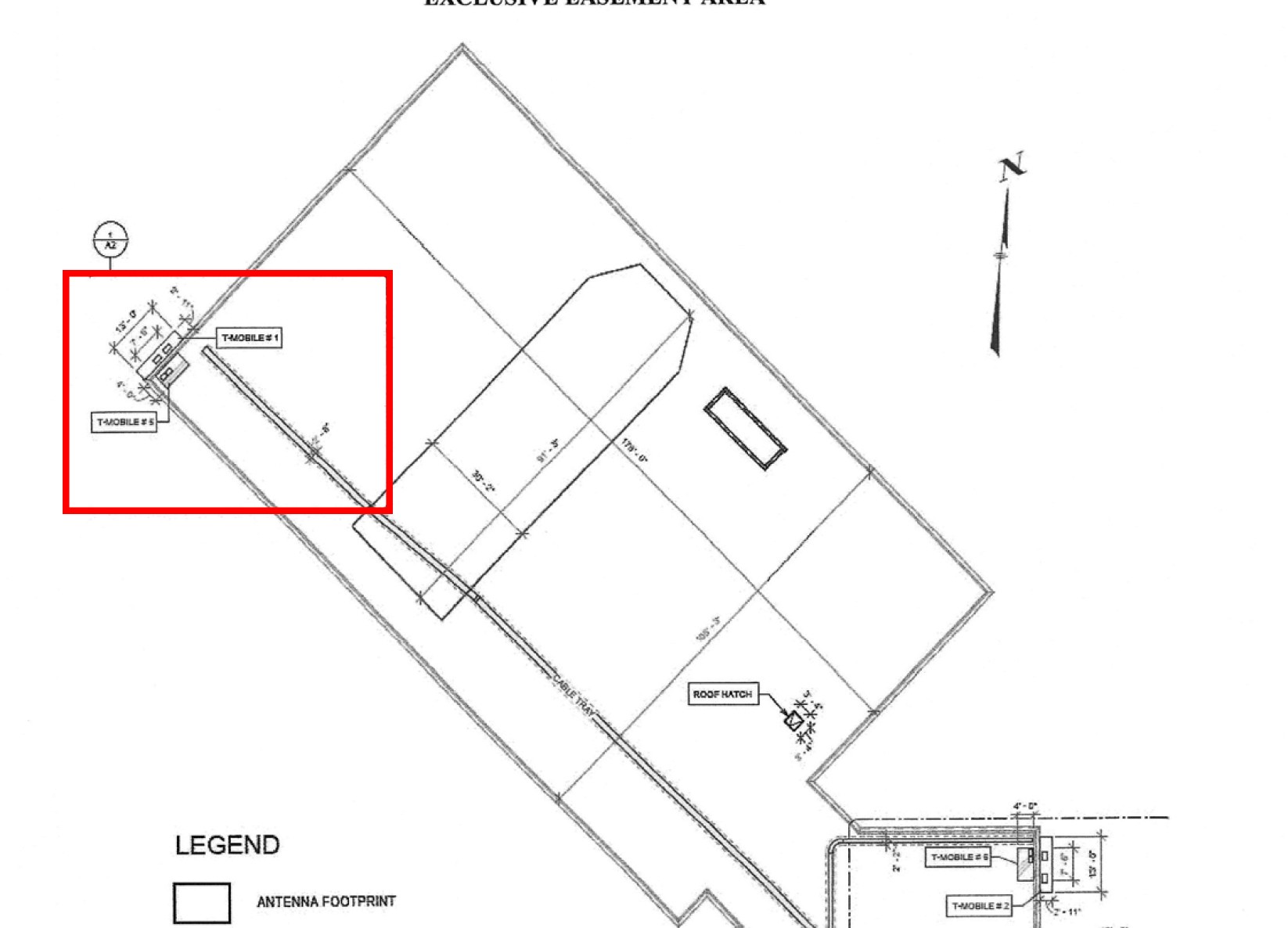

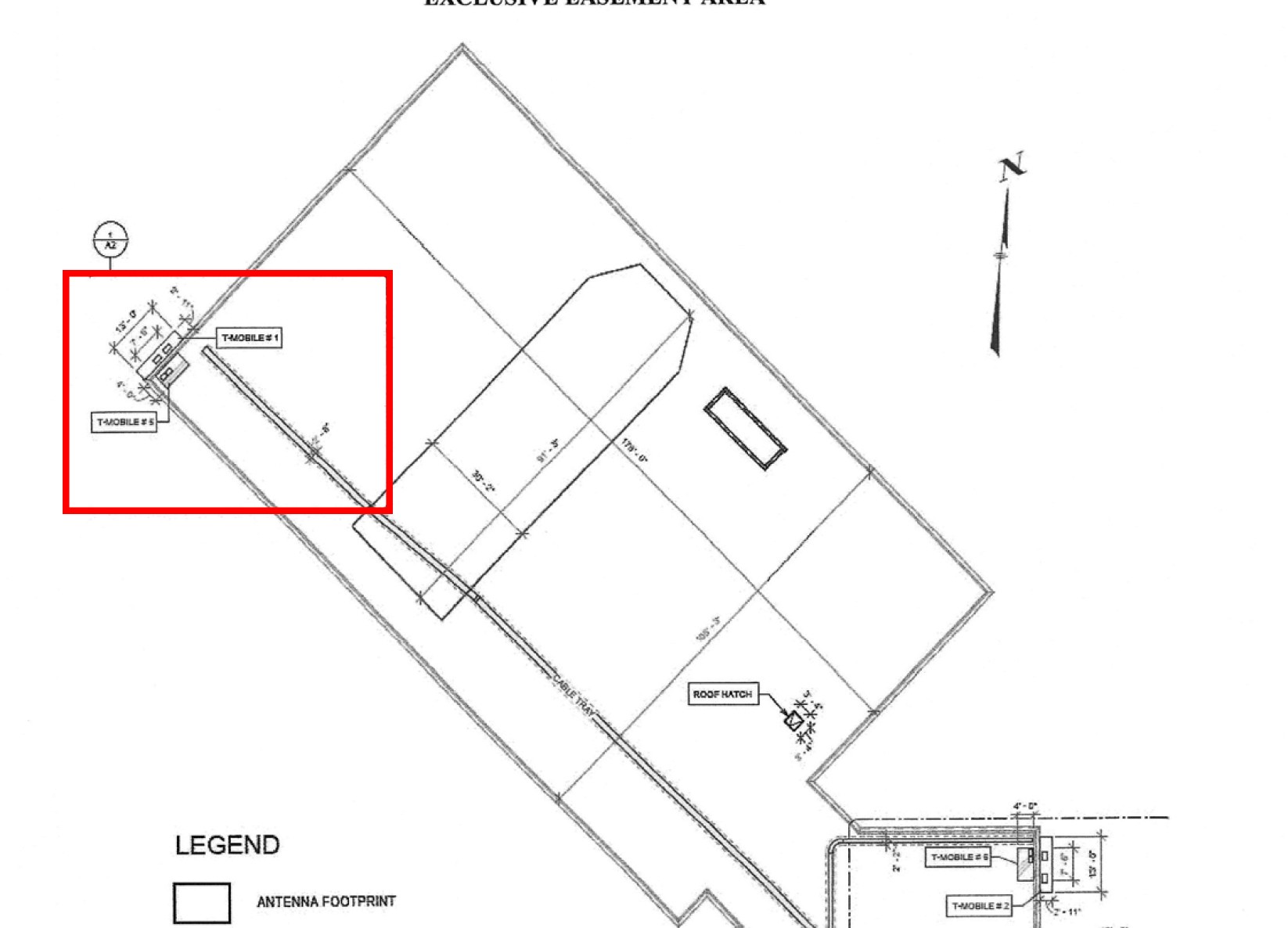

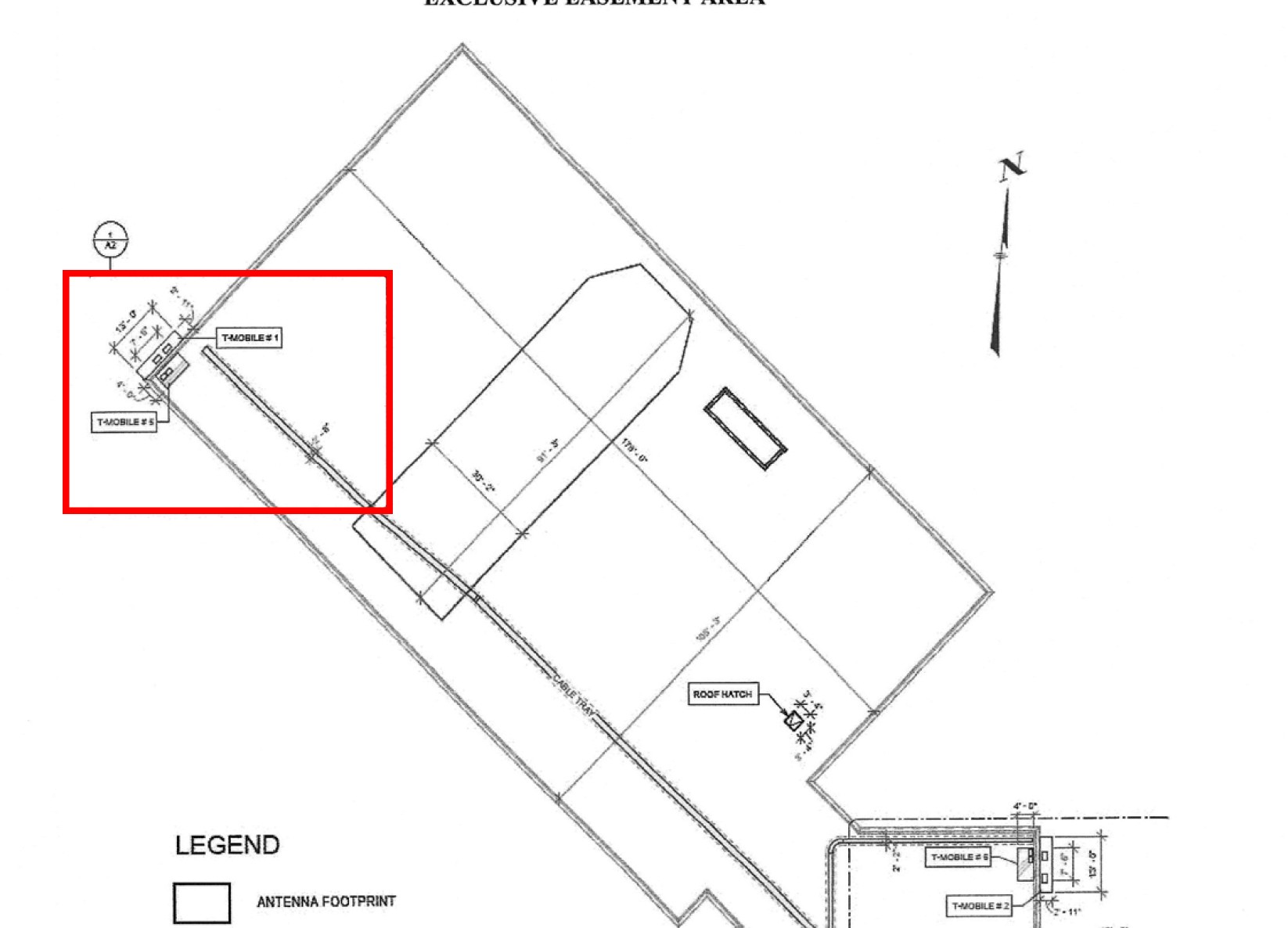

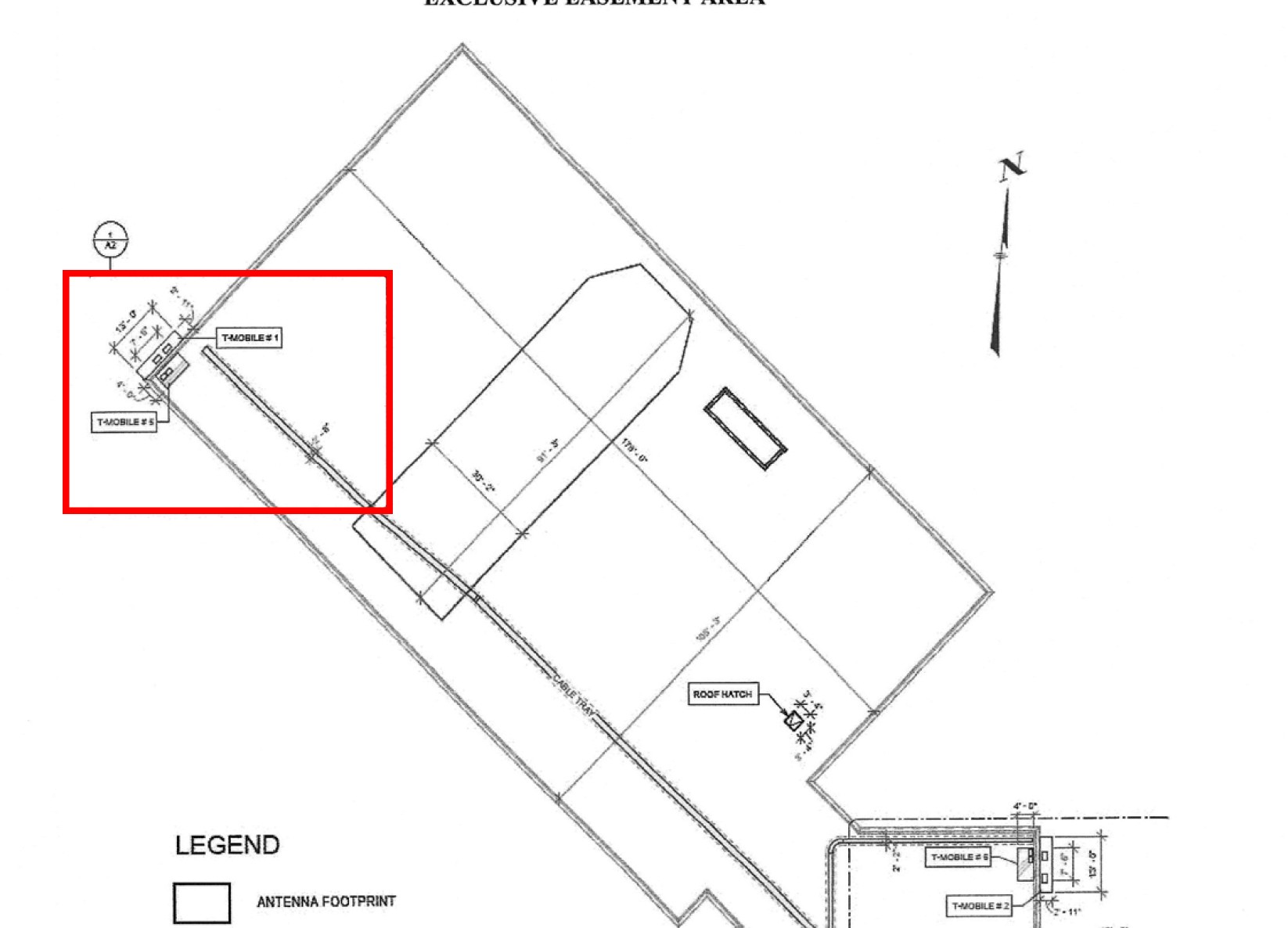

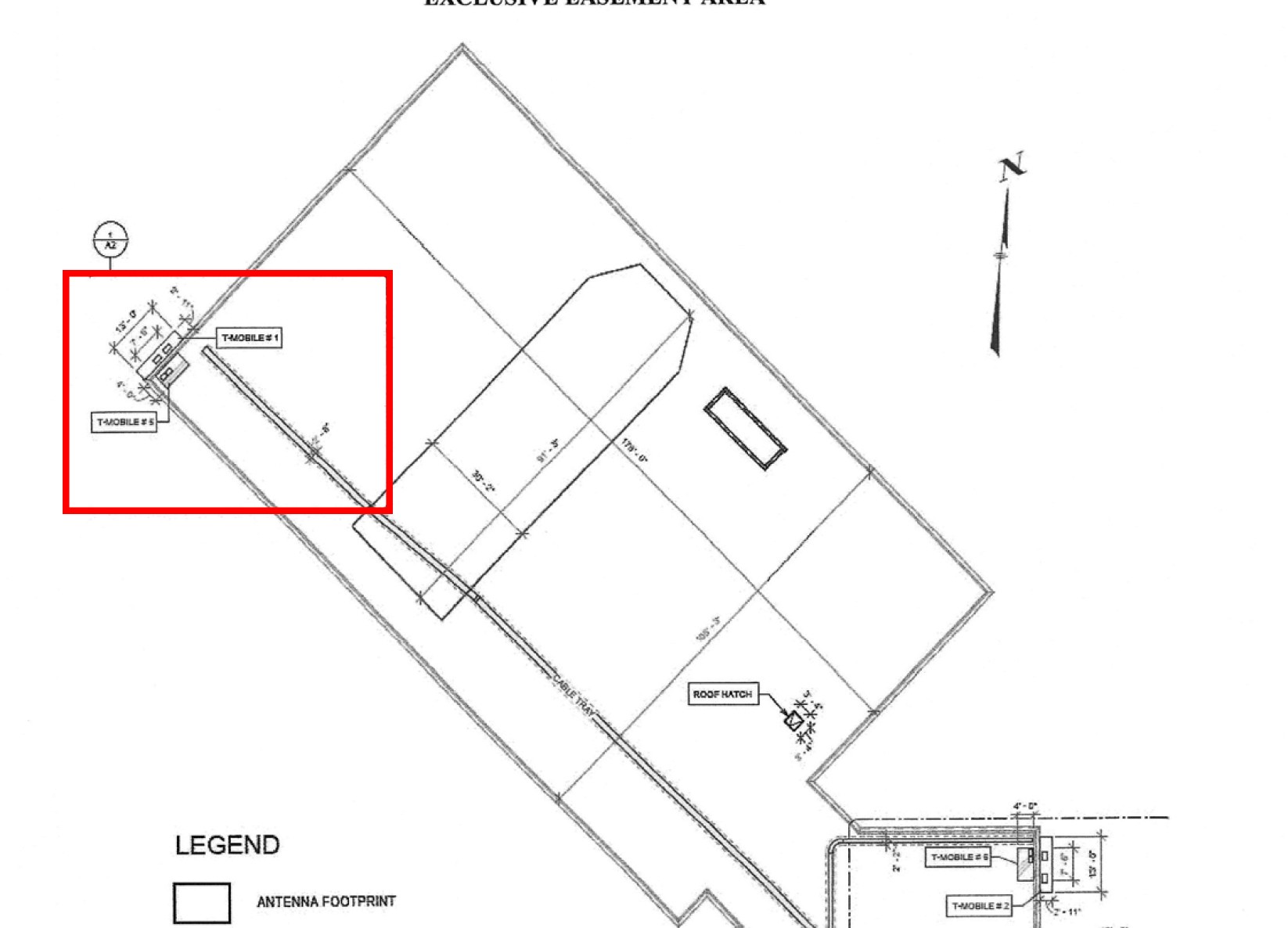

Space Center & Newport Cell Towers

(Partial Sale)

Colorado Springs, CO

Suburban Office

We completed the sale of cell tower easements at 985 Space Center, a suburban office property located in Colorado Springs. The transaction involved the disposition of easement rights associated with existing cell tower leases, while maintaining ownership of the underlying real estate.

This sale allowed us to monetize a component of the asset without impacting operations or long-term ownership, creating an arbitrage opportunity relative to the pricing of the overall asset. As a result, we realized a gain of $497,000 for the Fund and our partners.

Cell Towers at Space Center & Newport

Colorado Springs, CO

Suburban Office

We completed the sale of cell tower easements at Space Center & Newport, a suburban office property located in Colorado Springs. The transaction involved the disposition of easement rights associated with existing cell tower leases, while maintaining ownership of the underlying real estate.

This sale allowed us to monetize a component of the asset without impacting operations or long-term ownership, creating an arbitrage opportunity relative to the pricing of the overall asset. As a result, we realized a gain of $497,000 for the Fund and our partners.

Space Center & Newport Cell Towers

(Partial Sale)

Colorado Springs, CO

Suburban Office

We completed the sale of cell tower easements at 985 Space Center, a suburban office property located in Colorado Springs. The transaction involved the disposition of easement rights associated with existing cell tower leases, while maintaining ownership of the underlying real estate.

This sale allowed us to monetize a component of the asset without impacting operations or long-term ownership, creating an arbitrage opportunity relative to the pricing of the overall asset. As a result, we realized a gain of $497,000 for the Fund and our partners.

Cell Towers at Space Center & Newport

Colorado Springs, CO

Suburban Office

We completed the sale of cell tower easements at Space Center & Newport, a suburban office property located in Colorado Springs. The transaction involved the disposition of easement rights associated with existing cell tower leases, while maintaining ownership of the underlying real estate.

This sale allowed us to monetize a component of the asset without impacting operations or long-term ownership, creating an arbitrage opportunity relative to the pricing of the overall asset. As a result, we realized a gain of $497,000 for the Fund and our partners.

Photo: La Sal Mountains, UT

Q4 Acquisition Pipeline

Photo: La Sal Mountains, UT

Q4 Acquisition Pipeline

Photo: La Sal Mountains, UT

Q4 Acquisition Pipeline

Angus Village

Kennewick, WA

Retail

83,265 SF

Value Add

Angus Village

Kennewick, WA

Retail

83,265 SF

Value Add

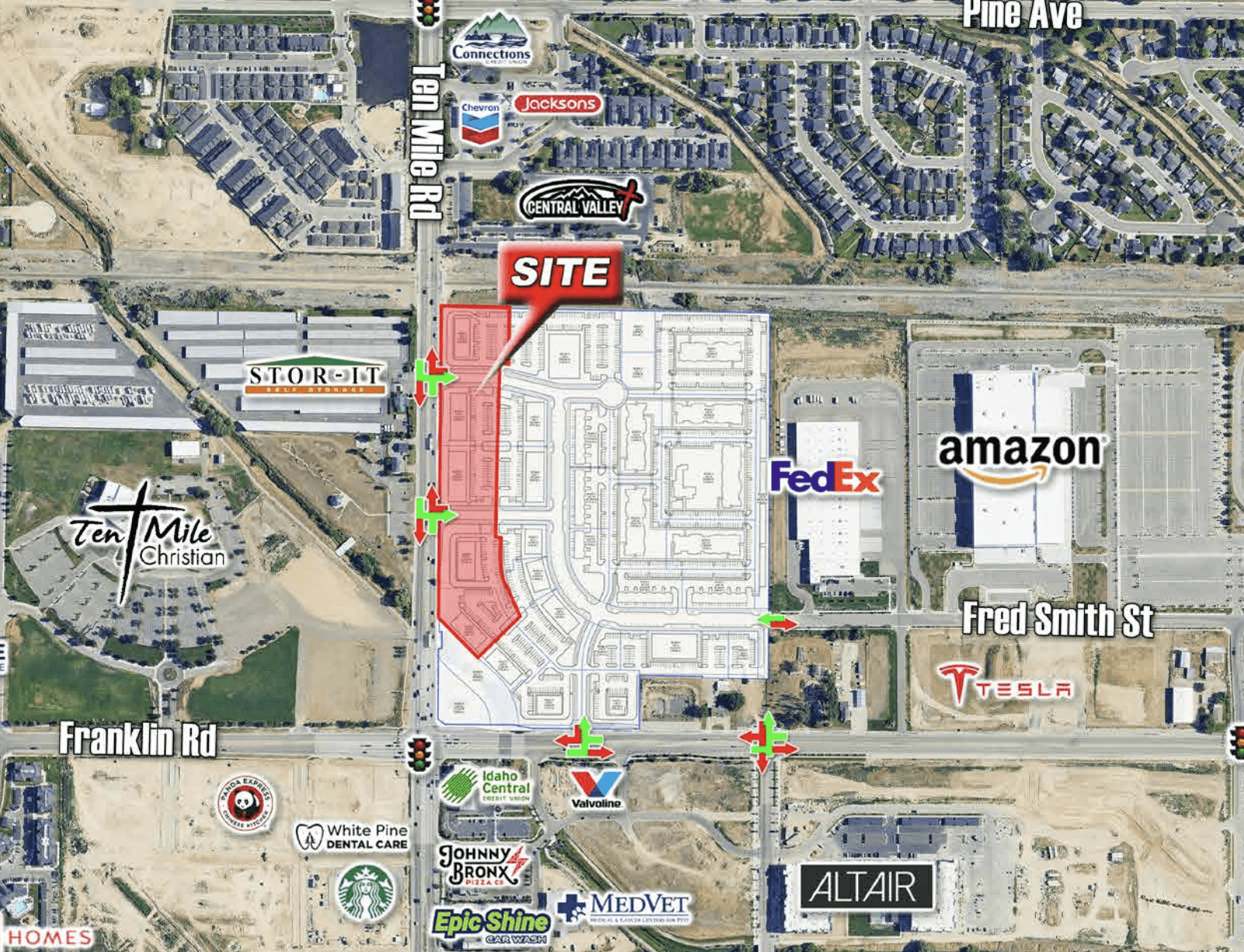

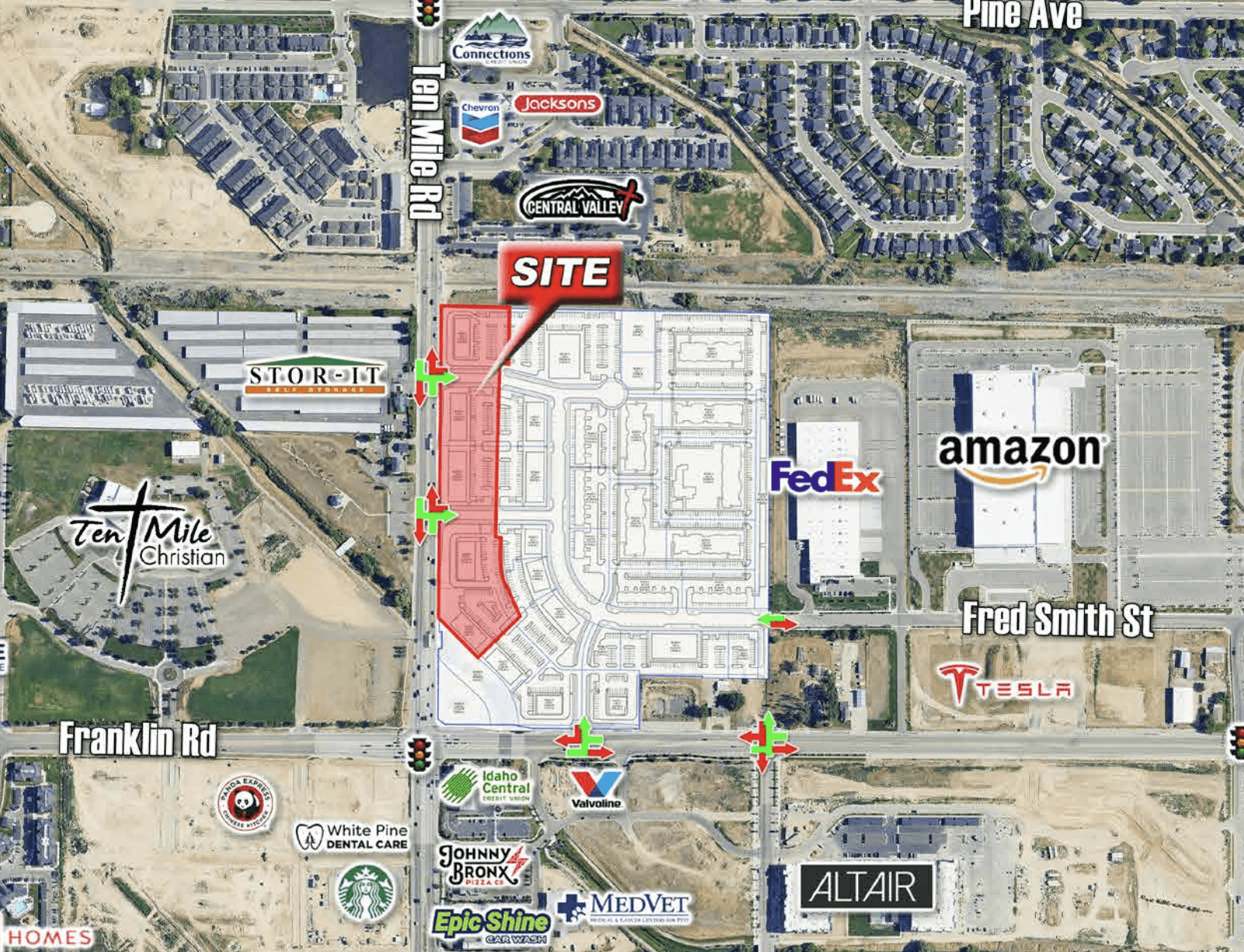

Gateway at Ten Mile

Meridian, ID

Retail

2.00 Acres

Build-to-Suit

Gateway at Ten Mile

Meridian, ID

Retail

2.00 Acres

Build-to-Suit

Walgreens

Idaho Falls, ID

Retail

14,820 SF

Core Plus

Walgreens

Idaho Falls, ID

Retail

14,820 SF

Core Plus

Walgreens

Idaho Falls, ID

Retail

14,820 SF

Core Plus

905 S 24th St

Billings, MT

Retail

100,800 SF

Value Add

905 S 24th St

Billings, MT

Retail

100,800 SF

Value Add

905 S 24th St

Billings, MT

Retail

100,800 SF

Value Add

Take 5

Several Locations

Retail

1,400 SF

Build-to-Suit

Take 5

Several Locations

Retail

1,400 SF

Build-to-Suit

Idaho Fitness Factory

Several Locations

Retail

11,600 SF

Build-to-Suit

Idaho Fitness Factory

Several Locations

Retail

11,600 SF

Build-to-Suit

Current Investments

83.96%

Occupancy Rate

83.96%

Occupancy Rate

88.88%

Lease Rate

88.88%

Lease Rate

4.09M SF

Total Square Feet

4.09M SF

Total Square Feet

1.79x

Debt Service Coverage Ratio

1.79x

Debt Service Coverage Ratio

$242.38M

Investor Capital

$242.38M

Investor Capital

46.43%

Current Reinvestment Rate

46.43%

Current Reinvestment Rate

Markets

Markets

Property Types

Property Types

Above charts are based on contributed capital.

83.96%

Occupancy Rate

88.88%

Lease Rate

4.09M SF

Total Square Feet

1.79x

Debt Service Coverage Ratio

$242.38M

Investor Capital

46.43%

Current Reinvestment Rate

Markets

Property Types

Above charts are based on contributed capital.

2025 Year In Review

10 plus years of building our team, our partnerships and our portfolio has given us optionality in how we generate returns for our investor partners. While returns from operations have been more difficult the last few years for reasons we have discussed (tenant turnover, construction cost, operating expense inflation, and higher interest rates) we are maintaining a solid base. We are working diligently to improve this, and it remains our top focus. In most cases, the trend is now positive, including cost inflation and interest rates, but most importantly from the tenant demand perspective. Demand for retail and industrial space remains very strong, and office demand is recovering, even in our weakest market (Denver). However, it takes time to see some of these changes reflected in the Fund’s returns, and while challenges may remain, the trends have begun to shift.

The Fund’s evergreen structure is a meaningful advantage for our partners because it allows us to be nimble and opportunistic across market cycles and investment strategies. We are not forced buyers when pricing is unattractive, nor are we forced sellers when the market is disconnected. The Fund’s structure provides diversification not only by asset class, geographical location, and tenant industry. Most importantly, it provides diversification over time. Having the ability to hold, improve, and realize the value created in these assets when conditions are favorable, allows value creation to compound. All these items, when coupled together, provide several levers to generate returns. Some of these include:

Completing development projects and generating returns on these assets either through sales or rent. Our current projects represent approximately $66.51M in total project cost, with an additional $27.47M in future development projects, that we will begin to realize in the coming years.

Selling assets where the value has been maximized. We have several properties similar to the assets we sold in 2025 (Adelmann, Decker Lake) that could be prime candidates to sell and reallocate that capital towards projects with stronger long-term return potential.

Selling components of assets at low cap rates (arbitrage). This is something we are considering with cell tower easements that trade for very low cap rates. This could also apply to pad sales at retail centers.

Leasing office space through our very successful spec suite program. To date, we successfully leased approximately 99,200 SF in spec suite space.

Adding additional accretive assets to the portfolio through acquisitions. While this has been more difficult in recent years, we have and will continue to create investment opportunities through our efforts and the efforts of our partners, and we expect this to accelerate (see Acquisition Pipeline).

Photo: Grand Teton National Park, WY

Financial Summary

Assets Under Management (AUM)

Photo: Bryce Canyon, UT

2025 Acquisitions

Photo: Bryce Canyon, UT

2025 Acquisitions

6

Total Acquisitions

6

Total Acquisitions

175,000 SF

Total Square Feet Acquired

175,000 SF

Total Square Feet Acquired

15.89 Acres

Total Acres Purchased for Development

15.89 Acres

Total Acres Purchased for Development

$37.91M

Total AUM Acquired

$37.91M

Total AUM Acquired

Photo: Grand Teton National Park, WY

2025 Dispositions

Photo: Grand Teton National Park, WY

2025 Dispositions

6

Dispositions

6

Dispositions

3

Partial Sales

3

Partial Sales

45.35%

Realized IRR

45.35%

Realized IRR

$30.91M

Total Sales Price

$30.91M

Total Sales Price

80,220 SF

Total Square Feet Sold

80,220 SF

Total Square Feet Sold

Photo: Byrce Canyon National Park, UT

2025 Leasing

Photo: Byrce Canyon National Park, UT

2025 Leasing

New Leases

New Leases

70

*New Leases Signed

381,000 SF

Square Feet

$5.62M

Annual Rent

Renewed Leases

Renewed Leases

93

Renewed Leases Signed

507,387 SF

Square Feet

$7.17M

Annual Rent

Total Leases

Total Leases

689

Total Leases

3,560,715 SF

Total SF Under Lease

88.88%

**Lease Rate as of 12/31/25

*Excludes in-place leases at properties acquired in 2025

**Percentage leased differs from portfolio occupancy rate due to leases signed where tenants had not yet taken occupancy.

Photo: Garden of the Gods, CO

2025 Investor Highlights

Photo: Garden of the Gods, CO

2025 Investor Highlights

12.43%

Realized Return

12.43%

Realized Return

13.60%

Total Return

13.60%

Total Return

40+

New Investor Partners

40+

New Investor Partners

$28.26M

Total Capital Raised

$28.26M

Total Capital Raised

Fund Description

The Alturas Real Estate Fund, LLC was formed by Alturas Capital Partners to provide accredited investors access to professionally managed real estate investments. The Fund is a $500 million equity offering created to make commercial and residential real estate investments. It targets middle-market properties frequently ignored by larger funds. These properties can be profitable as a diverse portfolio.

The Fund was created in May 2015 and owns properties in the Intermountain West and Inland Northwest. Managers of the Fund are continually searching for new properties to add to the Fund that meet strict underwriting criteria including a margin of safety, with a focus on cash flows.

Photo: Sawtooth Mountains, ID

Fund Description

The Alturas Real Estate Fund, LLC was formed by Alturas Capital Partners to provide accredited investors access to professionally managed real estate investments. The Fund is a $500 million equity offering created to make commercial and residential real estate investments. It targets middle-market properties frequently ignored by larger funds. These properties can be profitable as a diverse portfolio.

The Fund was created in May 2015 and owns properties in the Intermountain West and Inland Northwest. Managers of the Fund are continually searching for new properties to add to the Fund that meet strict underwriting criteria including a margin of safety, with a focus on cash flows.

Photo: Sawtooth Mountains, ID

2025 Year In Review

10 plus years of building our team, our partnerships and our portfolio has given us optionality in how we generate returns for our investor partners. While returns from operations have been more difficult the last few years for reasons we have discussed (tenant turnover, construction cost, operating expense inflation, and higher interest rates) we are maintaining a solid base. We are working diligently to improve this, and it remains our top focus. In most cases, the trend is now positive, including cost inflation and interest rates, but most importantly from the tenant demand perspective. Demand for retail and industrial space remains very strong, and office demand is recovering, even in our weakest market (Denver). However, it takes time to see some of these changes reflected in the Fund’s returns, and while challenges may remain, the trends have begun to shift.

The Fund’s evergreen structure is a meaningful advantage for our partners because it allows us to be nimble and opportunistic across market cycles and investment strategies. We are not forced buyers when pricing is unattractive, nor are we forced sellers when the market is disconnected. The Fund’s structure provides diversification not only by asset class, geographical location, and tenant industry. Most importantly, it provides diversification over time. Having the ability to hold, improve, and realize the value created in these assets when conditions are favorable, allows value creation to compound. All these items, when coupled together, provide several levers to generate returns. Some of these include:

Completing development projects and generating returns on these assets either through sales or rent. Our current projects represent approximately $66.51M in total project cost, with an additional $27.47M in future development projects, that we will begin to realize in the coming years.

Selling assets where the value has been maximized. We have several properties similar to the assets we sold in 2025 (Adelmann, Decker Lake) that could be prime candidates to sell and reallocate that capital towards projects with stronger long-term return potential.

Selling components of assets at low cap rates (arbitrage). This is something we are considering with cell tower easements that trade for very low cap rates. This could also apply to pad sales at retail centers.

Leasing office space through our very successful spec suite program. To date, we successfully leased approximately 99,200 SF in spec suite space.

Adding additional accretive assets to the portfolio through acquisitions. While this has been more difficult in recent years, we have and will continue to create investment opportunities through our efforts and the efforts of our partners, and we expect this to accelerate (see Acquisition Pipeline).

Photo: Grand Teton National Park, WY

Financial Summary

Assets Under Management (AUM)

Photo: Bryce Canyon, UT

2025 Acquisitions

Photo: Bryce Canyon, UT

2025 Acquisitions

6

Total Acquisitions

175,000 SF

Total Square Feet Acquired

15.89 Acres

Total Acres Purchased for Development

$37.91M

Total AUM Acquired

Photo: Grand Teton National Park, WY

2025 Dispositions

Photo: Grand Teton National Park, WY

2025 Dispositions

6

Dispositions

3

Partial Sales

45.35%

Realized IRR

$30.91M

Total Sales Price

80,220 SF

Total Square Feet Sold

Photo: Byrce Canyon National Park, UT

2025 Leasing

Photo: Byrce Canyon National Park, UT

2025 Leasing

New Leases

70

*New Leases Signed

381,000 SF

Average realized return

$5.62M

Annual Rent

Renewed Leases

93

Renewed Leases Signed

507,387 SF

Average realized return

$7.17M

Annual Rent

Total Leases

689

Total Leases 2024

3,977,527 SF

Average realized return

88.88%

**Lease Rate as of 12/31/25

*Excludes in-place leases at properties acquired in 2025

**Percentage leased differs from portfolio occupancy rate due to leases signed where tenants had not yet taken occupancy.

Photo: Garden of the Gods, CO

2025 Investor Highlights

Photo: Garden of the Gods, CO

2025 Investor Highlights

12.43%

Realized Return

13.60%

Total Return

40+

New Investor Partners

$28.26M

Total Capital Raised

Our Investment Offerings

Equity Offering

Our equity offering allows investors to invest in a diversified portfolio of commercial real estate assets focused on generating excellent ongoing returns from operations. The Fund's offering is best suited for investors who understand and align with the Fund's investment strategy and value long-term partnerships.

Targeted Total Returns: 9-14%

Preferred Return: 8% paid quarterly

Profit Split: 70% investors, 30% manager after preferred return

Fees: 1.5% asset management fee

Minimum Investment: $250,000

Fixed-Income Offering

Our fixed-income offering provides our partners with a fixed-income investment with attractive risk-adjusted returns and additional liquidity options. Investors can receive distributions in cash or accrue the interest earned throughout the life of the note. Upon maturity of the note investment, partners can reinvest their investment into another note, convert their funds into equity, or redeem their funds.

Interest Rate: 7-9% paid quarterly (rate dependent on duration and amount)

Investment Type: Promissory note

Security: Subordinate to property debt; senior to equity

Term: 24-60 months

Minimum Investment: $100,000

Our Investment Offerings

Equity Offering

Our equity offering allows investors to invest in a diversified portfolio of commercial real estate assets focused on generating excellent ongoing returns from operations. The Fund's offering is best suited for investors who understand and align with the Fund's investment strategy and value long-term partnerships.

Targeted Total Returns: 9-14%

Preferred Return: 8% paid quarterly

Profit Split: 70% investors, 30% manager after preferred return

Fees: 1.5% asset management fee

Minimum Investment: $250,000

Fixed-Income Offering

Our fixed-income offering provides our partners with a fixed-income investment with attractive risk-adjusted returns and additional liquidity options. Investors can receive distributions in cash or accrue the interest earned throughout the life of the note. Upon maturity of the note investment, partners can reinvest their investment into another note, convert their funds into equity, or redeem their funds.

Interest Rate: 7-9% paid quarterly (rate dependent on duration and amount)

Investment Type: Promissory note

Security: Subordinate to property debt; senior to equity

Term: 24-60 months

Minimum Investment: $100,000

All projections are hypothetical and predicated upon various assumptions that may or may not be identified as such. The future operating and financial performance information contained herein is for illustrative purposes and is not intended to portray any sort of targeted or anticipated returns. There can be no assurance that the Fund will achieve its investment objectives and actual performance may vary significantly.

Alturas Capital Partners, LLC and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal or accounting advice.